A STUDY ON THE WATER SECTOR IN CATALONIA, WHICH REPRESENTS €5.010M, 2.1% OF CATALAN GDP, IS PUBLISHED

- The strategic update study of the water sector is published within the framework of the XIV Ordinary General Assembly of the Catalan Water Partnership on the water sector in Catalonia and has been carried out by ESADE CREAPOLIS.

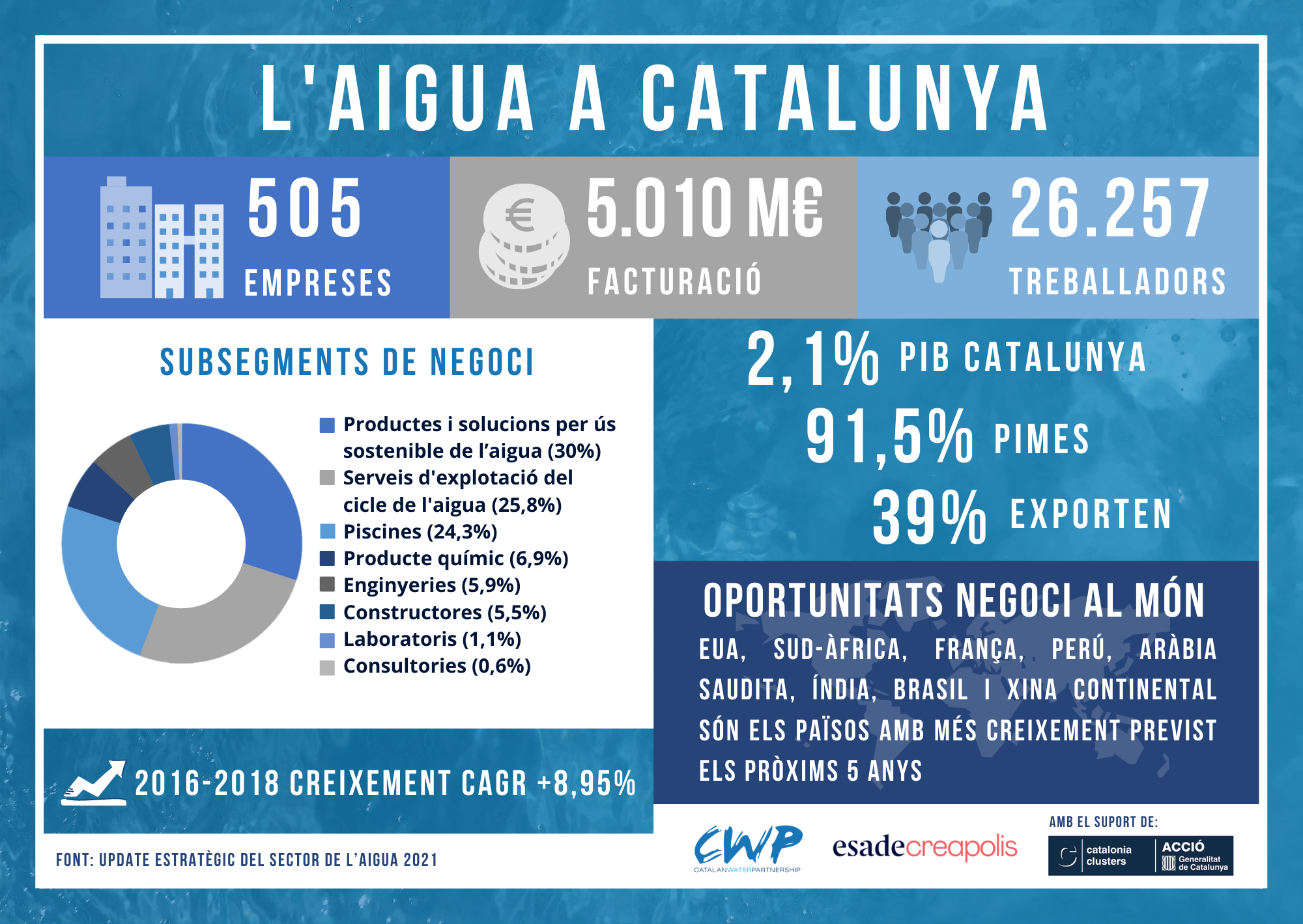

- The study of the water sector concludes that it is made up of 505 companies, with a turnover of 5,010 M €, 26,257 workers and represents 2.1% of the Catalan GDP. 91.5% of the companies are SMEs and more than 39% are exporters.

The study on the strategic update of the water sector in Catalonia was presented to the Ordinary General Assembly of the CWP on the 22nd of June. The study has been commissioned and coordinated by the Catalan Water Partnership and carried out by Esade Creapolis, with the support of the Generalitat de Catalunya through ACCIO. The sector has grown significantly since the study carried out four years ago by PwC, which showed an aggregate turnover of €4,480M and 23,184 workers. In recent years, the sector has grown especially in subsectors related to recreational water such as swimming pools, as well as in products and solutions for the sustainable use of water.

For its characterisation, the study defines the “water sector in Catalonia” as all those companies, entities and agents involved in the management of the complete water cycle, covering all of society’s water needs for domestic, industrial, agricultural and service use, from collection to supply, companies that share in the sustainable use of water. The water sector therefore brings together some of the most important water cycle management companies operating in Catalonia, such as industrial, chemical and service companies such as laboratories, engineering and construction companies related to water management. It also includes the swimming pool sub-sector, which has one of the world’s leading companies in Catalonia. The study is based on the latest data published before the pandemic.

Within this framework, a number of 505 companies have been identified that work in the water sector, with a total turnover of 9,304 M €, employing 37,858 workers. However, just counting the part of the business of these companies that is only linked to the water sector, it can be affirmed that it represents a volume of business exclusively linked to water of 5,010 M €, which represents 2.1% of the Catalan GDP and 26,257 workers. This study also highlights that 91.5% of the companies in the water sector are SMEs (with a turnover of less than 50 M € and less than 250 workers) and 88% are companies that were set up more than 10 years ago. It should also be noted that 39% of companies in the water sector are exporters and 10.7% have subsidiaries abroad.

The study also shows how the segment of design and/or manufacture of equipment, products and solutions for the complete cycle concentrates the highest turnover, with a total turnover of more than 1,900 M € (63.9%), and accumulates 44.1% of the total number of companies in the sector. It is followed by the segments of integral water cycle operation services (29.7%) and knowledge-intensive services (6.4%), which occupy second and third place in terms of turnover in the sector.

Likewise, the update of the sector’s data concludes that in Catalonia there is an extensive network of research centres in the field of water, and the water cluster of Catalonia as the entity that brings together the largest number of companies and as the main entity of the sector. In this sense, the president of the CWP, Mr. Jordi Cros, presents the study stating that: “The CWP is an important tool to improve competitiveness and to face the accelerated transformation that the sector has undergone in recent years. The circular economy, Industry 4.0, the commitment to innovation and internationalisation are at the heart of the projects that the cluster is currently promoting”. He also stressed that the cluster currently has 111 members, which in terms of turnover represent 60% of the sector. Mr. Xavier Amores, director of the CWP, went into more detail explaining that the projects and main activities carried out by the CWP during the past year have forced them to make important changes: “The ability to reinvent the activities of the entity, in a year without international missions, and where we have held virtual meetings with water associations in Australia, Holland or the USA and meetings with potential clients in countries such as Peru, South Africa or Mexico, among many others. We have multiplied our participation in European projects, obtaining €1M in funding for the coming years in projects that have a joint budget of more than €23M, being the Catalan cluster with more projects currently funded by Europe, and with major research projects in water reuse in the Mediterranean, circular economy, promotion of more sustainable ports, digitisation of the integral water cycle or projects to help sectors such as food and tourism to be more sustainable. “

The study also concludes the uniqueness of cluster initiatives at regional or small country level linked to the water sector. There are numerous clusters in Europe, the USA and Asia in sectors such as energy, food or ICT, to name a few of the most common, but the case of water is very unique, with comparable cases only in Leeuwarden in the Netherlands, Singapore, in the south of France, in the state of Victoria in Australia, Daegu in South Korea or in the state of Wisconsin in the USA. Important water research activities, the presence of some large leading companies in some of the key water sub-sectors, a significant number of SMEs throughout the value chain, together with once advanced water legislation, partly explain this concentration of the sector.

Finally, the study presents the set of challenges and opportunities that the water sector has to face in the coming years. The water sector in Catalonia faces important and urgent environmental, economic, political-regulatory and operational challenges, which make it necessary to carry out relevant changes in order to identify initiatives to improve the competitiveness of the sector. Digitalisation, the promotion of the circular economy and internationalisation take on even greater relevance in the Catalan Water Partnership’s strategy in the coming years. New challenges such as the identification of pollutants in wastewater and in general the water and health nexus as a result of the studies to identify Covidien-19 in wastewater have become more important, along with issues already present in the past such as microplastics, the energy-water nexus or the importance of water reuse.

The sector in the period 2016-2018 has had a positive evolution in terms of turnover, where there has been an improvement with a growth of 8.95% CAGR, and especially in the last year analysed, especially in the most industrial sectors and those related to the design and manufacture of products for the entire water cycle. Although the effects of Covidien-19 are not directly reflected in the study, as the latest data published are prior to the pandemic, it should be noted that the water cycle has been penalised by the crisis with the temporary drop in demand from industrial and commercial customers, as well as a reduction in residential consumption in tourist locations, impacts of the Covidien-19 crisis on the urban water cycle, although certain market segments have grown significantly and have very positive developments, such as the swimming pool sub-segment. The study also identifies the most attractive countries for opportunities in the coming years, including Peru, the USA, Saudi Arabia, India, Brazil, mainland China, South Africa and France, among others. It also identifies the most water-intensive industrial sectors or those with the greatest capacity for environmental investment, such as the food and chemical industries, with which CWP has been collaborating for years on projects, conferences and studies of the impact on water consumption in these sectors.